Ted Black gets back to basics with the cash-to-cash cycle and prays Cashbuild continues to do so

CASHBUILD released its best results yet in September. Though relatively small in terms of market capitalisation, it is SA’s leading building materials supplier.

For good reason, this company has fascinated management stu – dents and analysts for more than 20 years. It has had its bad times as many firms do and that’s when “get back to basics” always becomes the management mantra. There are only a handful, and tough-minded Pat Goldrick applied them after becoming CEO in 1997.

Published results since 1986 showthere is one success imperative for any firm, irrespective of whether it is an “old” or “new” economy one. It is the velocity of the cash-tocash cycle.

This is the measure: add the number of sales days of inventory you hold to the time it takes your customers to pay you. Next, subtract from that total the number of days you take to pay your suppliers.

If you end up with a negative number, it means you generate cash from your dayto- day and month-to-month operating cycles. You’ll have cash in the bank.

Many companies find it difficult, even impossible, to achieve zero or a negative cash-to-cash cycle. It depends on their business design and operating system.

Goldrick understands the measure because he has used his own cash to buy a chunk of the business and owns 10% of it. Being a genuine “owner ”, he thinks and acts like one. Moreover, unlike most “turnaround” managers who tend to bring some order and quickly move on, he is the company’s longest-serving CEO.

The cash-to-cash cycle governs a company’s viability and has done since the days of the pharaohs. It has nothing to do with the fashionable distinction made between “tangible” and “intangible” assets. Nor does it drift into asset theories that treat people as “human capital” and “brands ” as assets.

Cashbuild will be 30 years old next year and as Arie de Geus observed 10 years ago in his book, The Living Company, few firms reach that age. In contrast, the seasons of man’s life, tempered by lifestyle and disease, are programmed to take about 100 years to unfold.

Yet, for companies, infant mortality is high. Few survive the t h re e – ye a r “start-up” phase. Those that do can still die young. Hardly any celebrate 20 but they have the potential to last for hundreds of years.

The paradox is that, like people, firms are different but very much the same. They share a common reality that defines management’s threefold task, which is to:

- Make today’s business viable;

- Identify and unlock its hidden potential; and

- Turn it into tomorrow’s business.

EXHIBIT 1 provides a context. The universal “S-curve” reflects an organisation ’s pattern of growth, effort and results over time. Two more underpin it. The first is the bumpy learning curve.

EXHIBIT 1 provides a context. The universal “S-curve” reflects an organisation ’s pattern of growth, effort and results over time. Two more underpin it. The first is the bumpy learning curve.

When you launch a business, you drive for breakthrough with a superior product, technology or service that is low on the S-curve but has big potential. The model shows that a firm will not be economically productive during the start-up phase because of Murphy’s Law: “If anything can go wrong, it will.”

Learning is hard work. It consumes energy, resources and time. However, the inevitable mistakes become stepping stones to success. Once you reach a level of competence, the business is viable and can pay its bills. That’s when you step onto the experience curve and take many, purposeful steps to tap into the hidden potential.

You standardise ways of doing things but keep improving them. You build teams. Train people. Develop, redesign and entrench new systems and procedures that take wasteful practices out of the system.

When people do the work together and share knowledge instead of competing, productivity climbs and costs per unit plummet. You make lots of money and generate cash. Your company becomes a cashcompounding machine.

The Japanese call this stage Kaizen – the process of continuous improvement. After the Second World War, using knowledge of statistical process control and of experience curve effects first discovered in the US in the 1920s, they revolutionised productivity and achieved quality standards and levels of output that enabled them to capture many world markets through the 1960s, 70s and 80s.

A humiliated Western world eventually caught up by using the knowledge it had gained 60 years earlier but neglected. During the 1980s, the mantra was “total quality management”. Today, it has been rebranded as “Six Sigma” and converted into another fad.

When competitors catch up, performance peaks. The S-curve tops out and heads south. What won you leadership is out of date. The time for radical change puts you at the bottom of a new S-curve. If you don’t confront this reality, one of two things can happen:

- You drive the company crazy by injecting it with one-off, activity driven crash programmes; or

- You redouble your efforts with continuous improvement.

The first change strategy never works. With the second, you discover how futile it is to revive a company through, say, Six Sigma, if what it does is out of date. At best, you improve productivity and keep products going a bit longer. However, it’s a bit like putting a brain-dead person onto a life support system.

You breathe new life into a company by creating and maximising opportunities. If you continue to pour your best people, resources and effort into yesterday’s problems, your wheels may spin more efficiently but you sink ever deeper into a swamp of diminishing returns.

The S-curve is a great theory but not easy to use. Its great value is in helping you to decide what your initiative aims for. Are you going for “breakthrough ”? Or are you challenging the status quo — siphoning off resources to tap into the hidden potential lying dormant in the organisation?

With the benefit of hindsight, Cashbuild fits the model well. Albert Koopman led the company start-up in 1979 in the Metro Cash and Carry Group and beat the long odds against success.

Corporate start-ups rarely succeed because most managers lack the discipline of genuine entrepreneurs. They don’t have what used to be known as Joburg’s “Newtown ” MBA. Pat Goldrick does have one.

He started work as an ironmongery apprentice in Ireland aged 14. Fortunately, he lacks a “master’s degree in “business administration”— a qualification that would confuse and cause him permanent, bureaucratic brain damage. He knows that management is not a science. It is an art and a discipline that you can’t learn in a classroom.

Under Koopman, the company soon made profits and grew fast. Then in 1983, when there were nine branches, it ran out of steam. As he put it, rigor mortis set in. The fall in profits was only 11% — a bagatelle compared with the corporate collapses of recent years. However, it triggered a change process that revitalised the company.

He claimed the root cause of the problem was his autocratic management style. He felt it destroyed any hope of building a company of loyal, committed people. The change that followed was so successful it became a case study for business schools.

The academics argue that participative management releases people to be “the best”. Involve everyone in making decisions and improved results will follow.

With authoritarian styles of management governing most companies and institutions, the social unrest and escalating violence in the 1980s, the Cashbuild story did send an exciting message of hope. However, participation is only half of it.

Effective executives concern themselves with people and numbers. For Koopman and Goldrick, “empowerment” is not another form of patronising, debilitating socialism that promotes dependence, not autonomy. To executives like them, it means accepting responsibility and accountability for results.

EXHIBIT 2 trends some key ones. They are asset growth, the ROAM (return on assets managed) percentage and market capitalisation over the company’s lifetime since listing on the Johannesburg Stock Exchange in 1986.

EXHIBIT 2 trends some key ones. They are asset growth, the ROAM (return on assets managed) percentage and market capitalisation over the company’s lifetime since listing on the Johannesburg Stock Exchange in 1986.

The curves tell a story.

Koopman left soon after the listing and an acquisition in 1987 hiked the number of branches from 32 to 52 and sales hit R84m. ROAM fell from 16,5% to 10,7% but recovered to peak at 16,7% in 1991. Then it started its erratic 10-year descent to zero in 2000. However, there was a short up-tick after management abandoned a misguided change in strategy during the early 1990s.

To spur growth, it had decided to offer credit and created “Creditbuild” — a bad decision. Builders worldwide are notorious for being hugely inefficient. In SA they are no different. If you give them time to pay, you may never see your money.

Meanwhile, the branch network grew at a steady clip until 1996 when it had 108 outlets and sales of R880m. During the slide down the slippery slope, Koopman’s critics ignored the upward ROAM trend that followed his departure and the big acquisition. They argued his style was too soft and blamed it for the decline. The best way to get results is to “kick ass”, they said.

The fact is that Koopman did manage for results, as does Goldrick. Their styles may differ but, to paraphrase the late Peter Drucker, effective executives come in many types. Some are charismatic and ebullient. Others are shy and diffident. Some booze. Others don’t touch a drop. Some are warm, charming and intuitive. Others are cold, logical, and analytical — they have the personality of a round-eyed trout on a s l a b. All differ, but share one trait. They get the right things done.

Drucker described these “right things” — the fundamentals of management practice — in both Managing for Results and The Effective Executive, in the 1960s. No one has done it better. If there were a “top 10” of the best business books ever written, they would be on the list.

He observed that effective executives get their organisations to concentrate and focus on opportunity —the key to economic results.

In the late 1970s Koopman studied the building material supplies market in SA and saw how desperately black communities in rural areas and townships needed and wanted to build or upgrade homes. Despite widespread poverty and limited personal buying power, Koopman reckoned the market size to be R4bn a year. It was attractive but none of the established chains of builders’ merchants saw it that way. Only a few smaller, regional firms and many individual “owner-managed” businesses competed for it — thousands of them.

The big companies thought it too fragmented and high risk. However, Koopman transformed what others saw as a “problem ” into an “opportunity” and designed a business to capitalise on it.

First, he went where the big players weren’t. He chose to compete in towns with lots of black people living nearby. Locating away from big cities put it in a low-cost position. Branches cost less to build or rent and, because there were more people than jobs, salaries were lower.

Second, he applied the military rule of force — concentrate re-sources on a narrow front. He targeted smaller building contractors and black traders and went for leadership in that niche.

Third, he changed the game. He adapted the business to the economic and social realities of life facing the majority of South Africans by providing the building basics at lowest cost for cash.

Last, with personal growth, effective managers build on their own strengths and the strengths of people around them. Under Goldrick, the management profile at branch level has moved fast to reflect the country’s demographics: 50% of store managers are black and 15% of those are women. At senior level, 30% are black and 10% are women.

Today, having jumped onto a new S-curve that took the company from wholesaling to retailing, Goldrick sees the market opportunity as being R120bn and climbing. Although it is still highly fragmented with more than 3 000 individual players, other bigger firms such as Spar’s Buildit division, Massmart and Iliad are climbing into it.

To hold their leadership position in the face of intense competition, Cashbuild has erected some competitive barriers.

The first is to locate, build and revamp its stores fast to achieve the lowest capital cost per square metre of merchandising space. The stores are designed so as to erect the second barrier: to turn stock over quickly within a relatively small space. Third, Cashbuild works with suppliers to get the right stock in the store at the lowest price.

These three barriers combine to create a moat that makes Cashbuild the lowest-cost supplier in SA and positions it for aggressive defence and attack.

Last, although it operates with a low profit margin, it has to make enough to invest in the future — to train and develop staff and expand at a rate of 10 new stores a year.

These barriers protect the business. Cashbuild concentrates on a chosen segment and dominates it with focused operations. The success of its strategy makes it attractive, sexy, and safe for investors and all who do business with it.

Capital markets now rate the company as a relatively low-risk, high-return business in its sector and, as Exhibit 2 shows, reward it with a climbing share price and a market capitalisation that is bigger than the value of assets that Goldrick and his people are managing.

However, despite its success, there is a “problem-opportunity” looming — one that faces more and more companies as they introduce share ownership schemes which form part of their economic empowerment initiatives.

Giving employees precious equity through share options achieves nothing without a systematic education programme to go with it. In all companies, from boardroom level down, there is widespread ignorance about the rules of the game of business. People are just employees and kept that way. It creates a massive opportunity for productivity improvement.

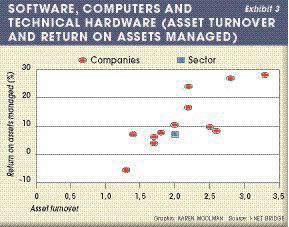

The prime measure of operating competence, one that few managers pay much attention to, is ROAM. As Drucker observed, if people work at it purposefully, day to day, year on year, it is the easiest and quickest way to improve the profitability of a business. The three key measures of ROAM are:

- Return on assets managed (ROAM) —the total profit of the business. This is,

- Profit margin or ROS% (operating profit ÷ sales x 100) multiplied by

- Asset turnover or ATO (sales ÷ assets).

The most important measure in this equation is asset turnover (ATO). It governs the cash-to-cash cycle. However, let’s first take Cashbuild’s return on sales percentage (ROS%).

EXHIBIT 3 shows the close correlation between its profit margin and ROAM since first listing on the JSE.

EXHIBIT 3 shows the close correlation between its profit margin and ROAM since first listing on the JSE.

On the X-axis is the return on sales percentage (ROS%). The higher it is, the higher the ROAM. The message sent by this chart is that Cashbuild has to keep ROS around the 5% mark if it wants a respectable ROAM. That’s the hurdle to keep beating. Even in a growth market, with increasing competition it is a tough ask. So where must they look to make a difference?

Asset Turnover (ATO) and its submeasure — stock turnover (sales ÷ stock) —powers the cashto- cash cycle.

Take a Cashbuild branch. Say it stocks one window at a time and sells it for R100. To get it sold costs R95. The profit is R5 and the profit margin is 5%. If it turns its window stock once a year — sells a window once — that’s a 5% return on the asset. If it can turn its stock twice —sell two of them — then return on the asset doubles to 10%. Sell it six times and the return is 30%.

To raise profit margins through increased selling prices, bigger volumes and cost-cutting in a highly competitive market is very difficult. Yet, to increase asset turnover by 10% and more a year by “turning” the inventory faster only means using the Cashbuilders ’ brains purposefully. It needs some consistent hard work inside the business, but especially with suppliers.

Goldrick took charge in 1997. Cashbuild ’s ATO for the years 1997 to 2007 averages out at 3,1. That means for every rand of assets that Cashbuild manages, it generates on average R3,10 of sales each year. In 2007, with an extra week, it generated R3,40. For the previous seven years, it averaged R2,90.

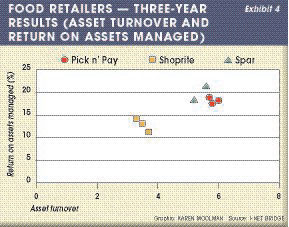

With the branch network growing steadily each year, Cashbuild ’s key lever for lifting asset productivity is inventory.

EXHIBIT 4 uses a statistical process behaviour chart — a valuable but rarely used management tool. It shows that the business model — the system designed by management — generates the numbers.

EXHIBIT 4 uses a statistical process behaviour chart — a valuable but rarely used management tool. It shows that the business model — the system designed by management — generates the numbers.

The graph shows Cashbuild ’s sales productivity of stock since listing in 1986. It answers this question: for every rand of stock, how many Rands of sales do we generate?

The performance is typically random but relatively stable and predictable. The first plot, falling outside the upper limit in 1986, was probably due to year-end “window dressing” in preparation for the first year of the listing. Management most likely reduced stock as low as possible or used some accounting artifice to improve the result.

The time series from 1997 when Goldrick took charge shows that R1 of stock generates an average of R5,73 in sales. The task is to get it above R6—say R6,50 —a 13% improvement. Goldrick would probably expect more than that to get the brains really working.

To expand this “problem/opportunity”, the company is about to install a system from SAP. Will this help or hinder it?

A recent Economist article posed a question about SAP’s new product launch — a web based product code-named A1S. It asked if SAP could overcome its history of selling complicated software to big businesses. A systems consultant replied: “People still haven’t forgotten that implementing SAP is like pouring concrete into a company.”

The last thing shareholders would want is for an entrepreneurial company such as Cashbuild to be throttled by bureaucracy. It is a very real threat. A recent study by Micro Focus® of some the world’s leading companies across five countries in Europe found that they ignore the size and value of the IT assets under their control.

Less than half of chief financial and information officers try to quantify the value of these assets and, even more appalling, less than a third have ever tried to value their contribution to business performance. That won’t surprise long-suffering operating managers but it is bad news for Cashbuild — unless they approach things differently.

Effective managers perform well with or without IT systems. If high-performance IT people, not high-tech ones, supported them they could probably achieve spectacular results. IT people are among the most talented in organisations. However, they only talk the ROAM and management of change games. They don’t play them.

If they want to play the game of business, they must start seeing themselves as a centre for value creation, not technology. To be a “fee-for-service” firm is less important than attitude, self-image and mission. If they hold the view that “you can’t operate without us”, they will never deliver the way they could and should.

So, that’s the Kaizen’s goal for the next year or so —to get Cashbuild ’s new IT assets to deliver a ROAM higher than today’s 18%. For IT and financial people it is more of a “breakthrough ” goal, but the company is still on the “retailing ” experience curve.

The omens for immediate improvement are not good. During the late 1990s research indicated that most enterprise resource planning implementations tend to depress ROS and ROAM for a few years before they deliver economic results. Look at BCX’s results for the last two years for proof of that. By its own admission, the company whacked itself with a SAP implementation. That’s hardly surprising when we learn that most financial and IT people can’t be bothered to measure themselves anyway.

Because Cashbuild operates with a low ROS percentage and Goldrick is a genuine “owner ”, perhaps it won’t fall prey to accountants and IT “techies”. If they don’t, then we’ll have a wonderful success story worth the retelling and more great lessons from them.

Ted Black (jeblack@icon.- co.za) writes, coaches and conducts ROAM workshops that help managers design results driven projects.

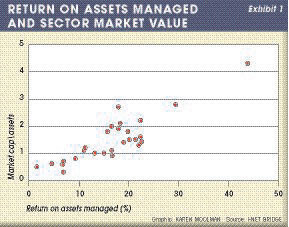

SABMiller ’s market capitalisation has grown roughly in line with the growth of the asset base through 2004 to this year —about 190%. Exhibit 2 shows the effect of this over the past 10 years on asset productivity — a steady fall from right to left. You could call it “brewer’s droop” after SABMiller’s involvement in the consolidation “beer bust” of the past 10 years.

SABMiller ’s market capitalisation has grown roughly in line with the growth of the asset base through 2004 to this year —about 190%. Exhibit 2 shows the effect of this over the past 10 years on asset productivity — a steady fall from right to left. You could call it “brewer’s droop” after SABMiller’s involvement in the consolidation “beer bust” of the past 10 years. Low ATO companies rarely see good returns, but high margins compensate for it in the beer sector. The highest ROAM is Modelo’s 20,6% in Mexico — its return on sales is 28%. Unless you have “orderly market arrangements” as most big South African firms seem to, or you have a monopoly, low asset productivity means trouble.

Low ATO companies rarely see good returns, but high margins compensate for it in the beer sector. The highest ROAM is Modelo’s 20,6% in Mexico — its return on sales is 28%. Unless you have “orderly market arrangements” as most big South African firms seem to, or you have a monopoly, low asset productivity means trouble. Once the InBev deal is consummated, and $35bn is added to its asset base, Anheuser Busch will collapse in a heap in the left-hand corner along with its Chinese interests. Its ATO will be about 0,2.

Once the InBev deal is consummated, and $35bn is added to its asset base, Anheuser Busch will collapse in a heap in the left-hand corner along with its Chinese interests. Its ATO will be about 0,2. EXHIBIT 1 provides a context. The universal “S-curve” reflects an organisation ’s pattern of growth, effort and results over time. Two more underpin it. The first is the bumpy learning curve.

EXHIBIT 1 provides a context. The universal “S-curve” reflects an organisation ’s pattern of growth, effort and results over time. Two more underpin it. The first is the bumpy learning curve. EXHIBIT 2 trends some key ones. They are asset growth, the ROAM (return on assets managed) percentage and market capitalisation over the company’s lifetime since listing on the Johannesburg Stock Exchange in 1986.

EXHIBIT 2 trends some key ones. They are asset growth, the ROAM (return on assets managed) percentage and market capitalisation over the company’s lifetime since listing on the Johannesburg Stock Exchange in 1986. EXHIBIT 3 shows the close correlation between its profit margin and ROAM since first listing on the JSE.

EXHIBIT 3 shows the close correlation between its profit margin and ROAM since first listing on the JSE. EXHIBIT 4 uses a statistical process behaviour chart — a valuable but rarely used management tool. It shows that the business model — the system designed by management — generates the numbers.

EXHIBIT 4 uses a statistical process behaviour chart — a valuable but rarely used management tool. It shows that the business model — the system designed by management — generates the numbers.

The best hope for SA would be a privileged, multiracial elite perched atop a simmering cauldron of repressed expectations never to be met. That’s a message of fear. Instead, take the next steps and go for the message of hope: reframe the problem into an opportunity and convert it into a simple, measurable goal.

The best hope for SA would be a privileged, multiracial elite perched atop a simmering cauldron of repressed expectations never to be met. That’s a message of fear. Instead, take the next steps and go for the message of hope: reframe the problem into an opportunity and convert it into a simple, measurable goal. Second, the basic rules of business have not changed one iota since the days of the pharaohs. So, you may ask: “What are these basic rules of business?”

Second, the basic rules of business have not changed one iota since the days of the pharaohs. So, you may ask: “What are these basic rules of business?” Return on assets managed collapsed from a once heady 25% a few years ago to below zero and now to what management calls a “solid turnaround” of 2%. Will a new share scheme make any difference to the performance graph?

Return on assets managed collapsed from a once heady 25% a few years ago to below zero and now to what management calls a “solid turnaround” of 2%. Will a new share scheme make any difference to the performance graph?